The Ultimate Guide to Choosing a Forex Trading Broker

In the competitive world of Forex trading, one of the most crucial decisions you will make is choosing the right trading broker. The broker you select can significantly influence your trading experience, profit potential, and overall success in the Forex market. Whether you are a novice trader or an experienced investor, understanding what to look for in a Forex trading broker is essential. Here, we outline several key factors to consider when making your selection, while also highlighting useful resources such as forex trading broker ex-zar.com.

1. Regulatory Compliance

The first step in choosing a Forex trading broker is to ensure that they are regulated by a reputable financial authority. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC) in Australia, provide oversight to protect traders and maintain market integrity. Always verify a broker’s regulatory status on their website and check for any compliance issues or penalties they may have faced in the past.

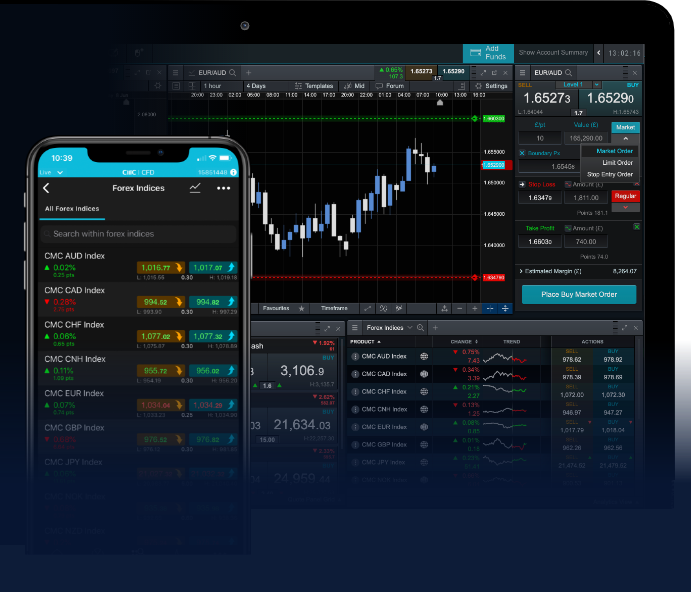

2. Trading Platform and Tools

A user-friendly and functional trading platform is crucial for Forex trading. Most reputable brokers offer platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which provide advanced charting tools, technical indicators, and various order types. Additionally, consider whether the broker offers a mobile trading app, as this can enhance your ability to trade on the go. Evaluate the platform’s interface, ease of use, and unique features to ensure it aligns with your trading style.

3. Spread and Commission Costs

Understanding the costs associated with trading is vital. Forex brokers typically charge a spread, which is the difference between the buying and selling price of a currency pair. Some brokers also charge commissions. Evaluate the spreads and commissions to determine the total cost of trading with each broker. Low spreads can save you money and improve your profitability, particularly if you plan on making many trades.

4. Leverage and Margin Requirements

Leverage allows traders to control larger positions with a smaller amount of capital, which can amplify both profits and losses. Different brokers offer varying levels of leverage, usually between 1:30 and 1:500. However, higher leverage comes with increased risk. It’s essential to understand your risk tolerance and choose a broker that offers leverage suitable for your trading strategy.

5. Customer Support

Excellent customer service is vital, especially for traders who may encounter issues or have questions about their accounts. Assess the availability of customer support channels, such as live chat, email, or phone support. A responsive and knowledgeable support team can greatly enhance your trading experience, providing assistance when you need it most.

6. Account Types and Minimum Deposits

Many brokers offer different account types designed to cater to various traders’ needs. Some accounts may require higher minimum deposits while offering additional features like improved spreads or access to premium trading tools. Assess your budget and trading requirements to select an account type that aligns with your goals. Additionally, some brokers offer demo accounts, enabling you to practice trading without financial risk.

7. Educational Resources

For novice traders, educational resources are invaluable. Many brokers provide webinars, tutorials, articles, and market analysis to help traders improve their skills and knowledge. These resources can be particularly beneficial if you are just starting out. Choose a broker that prioritizes education and offers a range of training materials to help you become a more successful trader.

8. Withdrawal and Deposit Options

Having flexible and convenient deposit and withdrawal options is crucial for efficient trading. Check the methods available for funding your account and withdrawing your profits. Popular payment methods include credit cards, bank transfers, and e-wallets like PayPal or Skrill. Make sure to consider any fees associated with deposits and withdrawals, as these can affect your overall trading costs.

9. Reputation and Reviews

Before settling on a broker, research their reputation in the Forex trading community. Look for reviews and testimonials from other traders to get a sense of the broker’s reliability and integrity. Online forums and social media can be helpful in gathering information about a broker’s reputation. Be cautious of brokers with numerous negative reviews or unresolved complaints, as these may indicate potential risks.

10. Security Measures

Ensuring the security of your funds and personal information should be a top priority when selecting a Forex trading broker. Reputable brokers implement robust security measures such as SSL encryption, two-factor authentication, and segregation of client funds. Confirm that the broker you choose prioritizes your safety and complies with industry security standards.

Conclusion

Choosing the right Forex trading broker plays a pivotal role in your trading journey. By considering factors such as regulatory compliance, trading platforms, costs, and customer support, you can make an informed decision that aligns with your trading style and goals. Always conduct thorough research, and don’t hesitate to explore additional resources like ex-zar.com to gather more insights into your options. With the right broker by your side, you can navigate the Forex market with greater confidence and improve your chances of success.